Let’s be honest, if the US did something like this, the ultra wealthy who are already not paying taxes would find ways to game more money out of the system.

But it could still help a lot of people.

Also, in “things that will never happen in the US” we have universal healthcare

This gets proposed as a way to implement basic income (UBI). It is only equivalent when the lowest tax bracket is equal to the NIT.

ex: if NIT of 25% up to $40k, and 25% income tax rate up to $50k, then at $40k income, you would pay 0 net income tax. At 0 income, you would receive $10k, and at $50k income, you’d pay $2500. Every $10k of income results in $2500 extra taxes or less of a refund.

Milton Friedman’s version of NIT was at 50% for low income ($20k), and then fairly low tax bracket rates (20%) above that. This means that the poorest people are taxed very high on income, and middle to high incomes pay a lower rate. Welfare and unemployment systems often use such a 50% clawback. It is a significant disincentive to work, unless you will make a lot during a year.

Refundable tax credits is a similar system of permitting net refunds to people even if they pay no income taxes.

You say negative income tax, I hear business subsidies.

That’s just equivalent to UBI, isn’t it? If you pay out UBI and get the money for it from taxes, then there’s an income level below which people net gain money and above which people net lose money.

It is UBI with a “clawback”. Conservative (Friedman’s NIT version) and left wing (called Guaranteed income) versions of UBI like to place an ultra high tax/clawback rate on the lowest income levels. It is same as UBI if lower tax brackets are not the first bracket after “personal UBI received is paid back in taxes”

How is it a negative income tax if they are taking money from the lowest bracket? That’s the bracket where an NIT gives money instead of taking it.

A NIT of 50% up to $20k income is equivalent to UBI of $10k with 50% as the lowest tax bracket. Under both, you pay 0 net tax at exactly $20k income, and you get a $10k refund at 0 other income.

Either one is still a 50% marginal tax rate no matter the name. On every $ you earn you only keep 50cents.

This still doesn’t make sense to me. The UBI clawback that starts small and grows with each bracket makes sense. At 0 earned you get 20,000. And it’s not until you hit the poverty line that it starts gradually being taxed back. So a family of four would pay 5 or 10 percent back if they were in the 40k-50k bucket.

It seems to me you’re not discussing a NIT which pays money to workers, but rather a national minimum wage through the tax system. In this case 10,000 dollars. An NIT doesn’t need a clawback because it diminishes as you go up in tax brackets. A UBI uses it to remove administrative overhead from issuing it and to make it clear that every adult, employed or not, is eligible.

NIT is paid to workers and non workers alike. As is UBI. The maximum NIT refund you get is at 0 earned income. When you earn income, your refund is lowered. That starts at $1 of income. Even if it is called a negative tax, it is still a positive marginal tax rate that reduces your net income for every $ earned.

An NIT refund comes from the IRS, while UBI can come from IRS or another department. They are still highly related concepts. Other than the most famous NIT proposal has a 50% tax rate on the lower incomes, and frequenly left leaning politicians, instead of UBI propose Guaranteed Minimum Income, with tax rates of 50% to 100% on the lowest incomes.

Sensible UBI plans use normal tax rates with higher rates on upper incomes if needed.

When you say a tax rate of 50-100 percent, are you referring to the negative tax rate?

Guaranteed minimum income plans are either a 100% tax, when literally, all get a minimum income of say $20k, if you earned less than $20k, you don’t keep any of those earnings. Practical, still left of center plans do change this to a more modest 50% clawback rate similar to welfare/EI. The most famous NIT proposal had a 50% tax rate on the lowest income. That is the exact same as the flawed GMI plans.

No, negative income tax usually requires that you make some money and file taxes. UBI doesn’t.

One has the intention of encouraging workforce participation. The other tries to help everyone.

Please edit the title of your You Should Know post to begin with “YSK”. It’s Rule 1 of the community. Thank you.

Thank you

Negative Income tax could operate like UBI. The hero of neoliberalism Milton Freedman supported a scheme to transfer wealth like this.

As an example: this exists in Flanders (dutch speaking part of Belgium): https://www.brusselstimes.com/316484/job-bonus-for-730000-people-in-flanders-how-to-make-sure-you-get-yours

The US doesn’t technically have a negative tax, but the EITC accomplishes the same basic thing. Whether it’s efficient enough, or needs expansion is another story.

but what about -~- LOOPHOLE WHACKAMOLE -~- its not technically free for billionaires since they have to pay so much to lawyers

Wouldn’t it make more sense to, like, have the first 12k dollars tax free and then increase the percentage for everything exceeding this threshold? The more money you earn, the more taxes you can afford to pay. Especially when you earn only little money this is important for you to survive, while $100k/yr managers could easily afford to pay 50k of those in taxes

A negative income that is better than that. It says, if you’re working, but only making $12k, the state will give you money so you now have $20k. (Not real numbers.)

The idea is that it incentivizes participation in the work force, with hopes that the extra money helps you get stable and move up the payscale where you may stop needing the external support.

How does that incentivizes workforce participation? You’re giving them money to not work, I think graduated taxes should just not have the NIT portion.

No. If you reported $0 in income on your taxes, you get nothing. There’s a minimum income to get anything back. So if you don’t work, you get nothing, so you are incentivized to find a job of some kind.

But that minimum should be quite low and attainable.

NIT is specifically letting people start in a refund position. 0 income gets the largest total refund.

Ah got it.

The system you are describing is what most countries use. This is basically just an extension of that intended for people who make so little they need extra assistance.

Actually, the US Earned Income Tax Credit is basically a version of negative income tax.

It is not. EITC is a tax reduction for the first few $1000s of employment income. NIT is a tax refund even if you pay no taxes.

EIT is a refundable tax credit. Meaning if your total tax burden is less than the credit, federal government will pay you the difference. A part of the child tax credit is the same.

What are the upside of that vs plain minimum wage?

Very signficant benefits of UBI over minimum wage laws. if for example UBI is equal to typical minimum wage of 2000 hours/year. $14k/year in US. ($7/hour)

Minimum wage means it is illegal to hire you for less, even if you would be happy to work for less. Maybe you are happy to work a couple of hours per day at a nearby library, but would like to get beer money for doing so instead of “internship”. UBI is equivalent to a $7/hour bonus on whatever wage your earn or don’t earn. You have the freedom to say no to work, and so you might accept better pay offers than if you are under structural desperation to survive. That power we all have means that we don’t need a minimum wage law. We all have enough fuck you money to not put up with excessive shit.

One of the key overlooked benefits of UBI is that it also encourages people to retire, move out of the workforce or drop back to part time sooner. Freeing up jobs for people to move into.

Once the house is paid off and the kids have moved out, etc. The “I dont NEED to do this” is real.

Why did you bring up UBI? UBI and NIT are nothing alike. UBI isn’t being discussed.

They can be exactly the same, but are always similar. NIT could be set such that $14k is the refund you get at 0 income, and it is clawed back to 0 at some other income level.

It reduces the onus on businesses and places it on the government (and this indirectly, taxpayers).

Better for small businesses to hire and thrive.

“But I don’t want my taxes to go up!”

Maybe you just need more tax brackets. Where I live, for some reason, a specialized doctor making $250,000/yr is in the same tax bracket as some C-suit making $900,000.

I definitely need more tax brackets where I live.

Never understood the idea of tax brackets. Why isn’t it just continuous? Computers are calculating the tax now anyway, not like it would be infeasible.

I mean to a degree it is continuous. To simplify things the first $10 you make isn’t taxed. $11 to $15 is taxed at rate A, $16 to $20 is taxed at rate B, etc. This is what is meant by the progressive tax system. Obviously these numbers are much higher in reality.

People who can’t understand this are the ones bragging that they turned down a raise because it would “change their tax bracket”. With one exception at very low income, called the benefits cliff, the more money you are paid the more money you take home after taxes.

Does this make tax brackets less confusing? I want to help you and anyone else reading to understand.

I think what they’re saying is that it shouldn’t be in steps, the tax rate should increase as income increases.

So $11 would be taxed at A.2, $12 at A.4, $13 at A.6 and so on. And $11.50 at A.3.

As it is, it’s more discrete than continuous (from a mathematical perspective). Another problem is that it usually stops. Like where I live, and it tops out at about $250,000.

You are just saying “have 1000 or 1m tax brackets” instead of 5. It is not super different other than being more complex.

You might still be thinking of it as discreet. It would kind of be like having infinite tax brackets.

But yeah, I too think it would be too confusing.

Yeah I get what they mean but that’s much more complex. I suppose that’s what computers are for but it could make it even harder for people to understand and so many people do not understand the current system.

Definitely agree we need more brackets after the top one. Although this only goes so far, as the more wealthy a person is the more likely their income isn’t classified as income anymore. I’d love to return to post WW2 tax rates on the rich but we need to do something to make them pay some kind of fair share. It’s disgusting what they get away with.

Sounds like a nightmare to try to explain to someone. Technically it should work, but practically it might be difficult.

Why? To me it’d be much more intuitive. I find brackets quite confusing

The brackets are pretty simple. It’s percentages and subtractions. Think “buckets” that spill over in the next when they’re full, and each “bucket” has a larger percentage that’s taken as taxes. Keep the numbers small so its easier. Imagine that there are three brackets. 0-100$ pays 10% tax. 101-200$ pays 20%. 200$ and more pays 30%.

Someone who wins 150$ pays 10% on the money they made from 0 to 100$, and 20% on the 101st dollar until their last, so they’ll win 150-10-10=130$ after tax. They didn’t win more than 200$, so no money gets taxed at the third bracket’s rate.

Say that person wins 250$ next year. Their first 100$ will result in the exact same 10$ in taxes. Their 100th to 199th dollars will be in the second 20% bracket. Their remaining 50$ falls in the last bracket, so gets taxed 30%. They will therefore this year make 250-10-20-15=205$ after tax.

Said person gets a big promotion and is now making 1000$ the third year. Their first 100$ gets the same 10$ tax, same for their second 200$ with the same 20$ tax. They have 800$ left in the last bracket, which at 30% means 240$. So they’d be winning 1000-10-20-240=730$ that year.

How would an infinitely adjusting tax percentage be intuitive? Brackets are simple. You pay x% on your income in some bracket and y% on your income in a different bracket. You only need simple multiplication and addition to figure out what you would owe.

A continuous bracket could be defined by a single equation. You’d plug in your income and you’d get out your taxation. No need to look up what bracket you are in.

If you expect the average person to be able to understand an algebraic equation better than the existing system, then I’d suggest you get out of your social bubble and meet more ‘average’ people.

Give it a shot. Let me see an equation.

Brackets are lobbied for. You cant lobby a straight line.

Tax brackets are there for progressive taxation. Progressive income taxation is the most fair form of taxation. The least fair is consumption tax - such as sales tax. Sales tax tax disproportionately burdens lower income households. Since most places have sales tax, an aggressive progression of income taxation is called for to balance the scales.

I’m not speaking against progressive taxation, I’m saying the brackets should be continuous so there aren’t any sharp turns in taxation. Right now the brackets make the taxation discrete, but I feel it should be continuous.

Oh I see. Well, you gotta understand the public don’t take too kindly to math. Especially politicians.

Could totally do a sigmoid function and just integrate over the income. But the brackets are just discrete approximation of that.

You still have brackets, but they’re at every $0.01

deleted by creator

Don’t give the super wealthy any ideas.

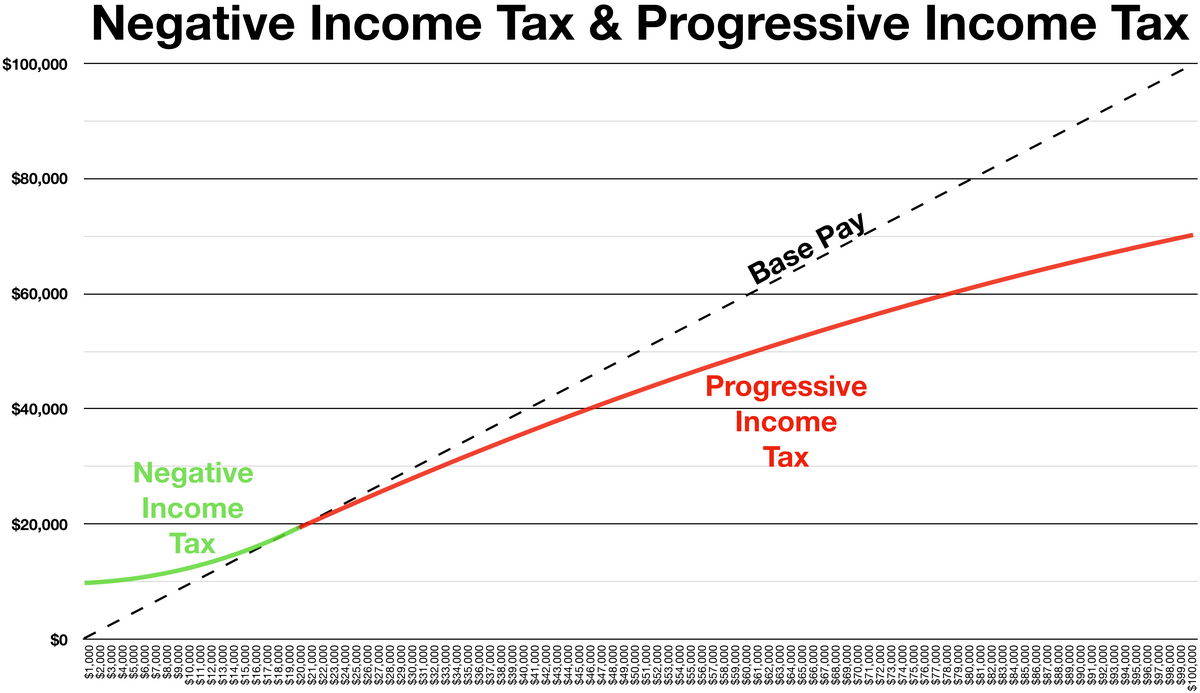

What a bad set of graphs! The first one is just wrong.

In what way?

The tax is never negative. Instead, it plots a progressive tax rate, and calls it “negative”.

The second graph is just confusing and detracts from the explanation instead of adding to it.

That graph plots gross pay (x-axis) against take-home cash (y-axis). The far left of the graph (in green) shows people making under 20k taking home more than their “earned” pay. At the extreme bottom is somebody making 1,000/year taking home 10,000. The progressive income tax starts at 20,000.

Not labeling the axises does make it hard to read.

Oh, that’s right. Yes, the graph is only bad and not wrong.

Good thing it’s a wiki!