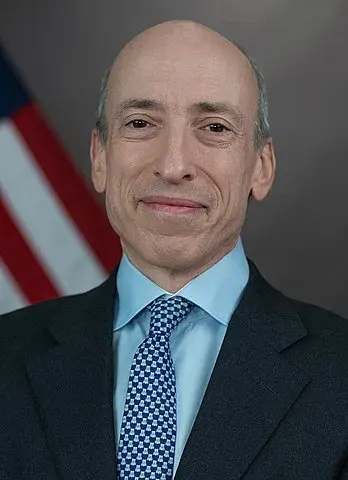

In the early hours of September 15, Ethereum completed "The Merge – the long-awaited transition from its original proof-of-work consensus mechanism to proof-of-stake.Later that day, SEC Chairman Gary Gensler pointed to the staking mechanism as a signal that an asset might be a security as determined by the Howey test.There has been much discussion over whether cryptocurrencies in general or individually should be considered securities, commodities, or possibly even something else. Broadly, people within the crypto community don't want to see the assets fall under SEC jurisdiction, as the SEC is seen as much less friendly to the industry than the CFTC.

Governments don’t like it when there is something they can’t control. That is why they hate crypto.

And cryptobros don’t like when anyone can hold them to account for their scams. That’s why they hate any oversight.

Crypto makes financial surveillance close to impossible. That is why governments hate it. Just because some opportunists are running scams it does not mean all of crypto is a scam.

Demonstrably false. Especially now that mixers like TornadoCash are getting banned.

Ah, the old “few bad apples” chestnut. Wake me up when the cryptocurrency community decides that these scams are a bad thing and something needs to be done about them, so far it looks like that community is more than happy they happen, as long as it helps provide liquidity to the space.

i’m reminded of how when dan olson did his big video on crypto at the beginning of the year he found the community more or less encouraged basic financial fraud schemes like pump-and-dumps and how if you made an NFT project–heavily tied to cryptocurrency–artificially inflating the value was a prerequisite to show you cared about your investors. the whole ecosystem is really just a nesting doll of scams, lol.

This. Here’s the video, and it’s absolutely worth a watch. Easy to watch in batches (it’s >2h long), I watched it over a week or so. Very well argued and evidenced.

While we’re at it, we need to talk about “market caps” and crypto-asset valuation. Molly White wrote a fantastic deep-dive into it. Tl;dr is: cryptocurrency valuation is inflated to high haven by what can best be described as “creative accounting”. Which is to say:

Bingo.

Isn’t it exactly the opposite, especially with crypto like Bitcoin?

Fundementally, yea. Cryptocurrency is really just a public ledger. With enough time and computing power, you can trace every transaction ever made. If you identify a wallet’s owner, you can watch everything they do.

Cryptocurrency is not cash in an envelope.